In this project, we faced the challenge of redesigning a loan platform with an outdated design that didn't align with the brand identity.

The motivation was to make the platform more competitive in the market by implementing basic features such as payment with balance and payment anticipation.

Our goal was to provide users with a modern and intuitive experience, making the loan process more convenient and efficient.

In the ideation process of the new identity for the banQi application, we focused on a simplified and practical design.

We updated the colors and visual identity to resemble the parent brand, Casas Bahia.

We also streamlined the screens and organized the information in a more minimalist manner, aiming for better user comprehension. The goal was to convey trust and modernity while staying aligned with the needs of the target audience.

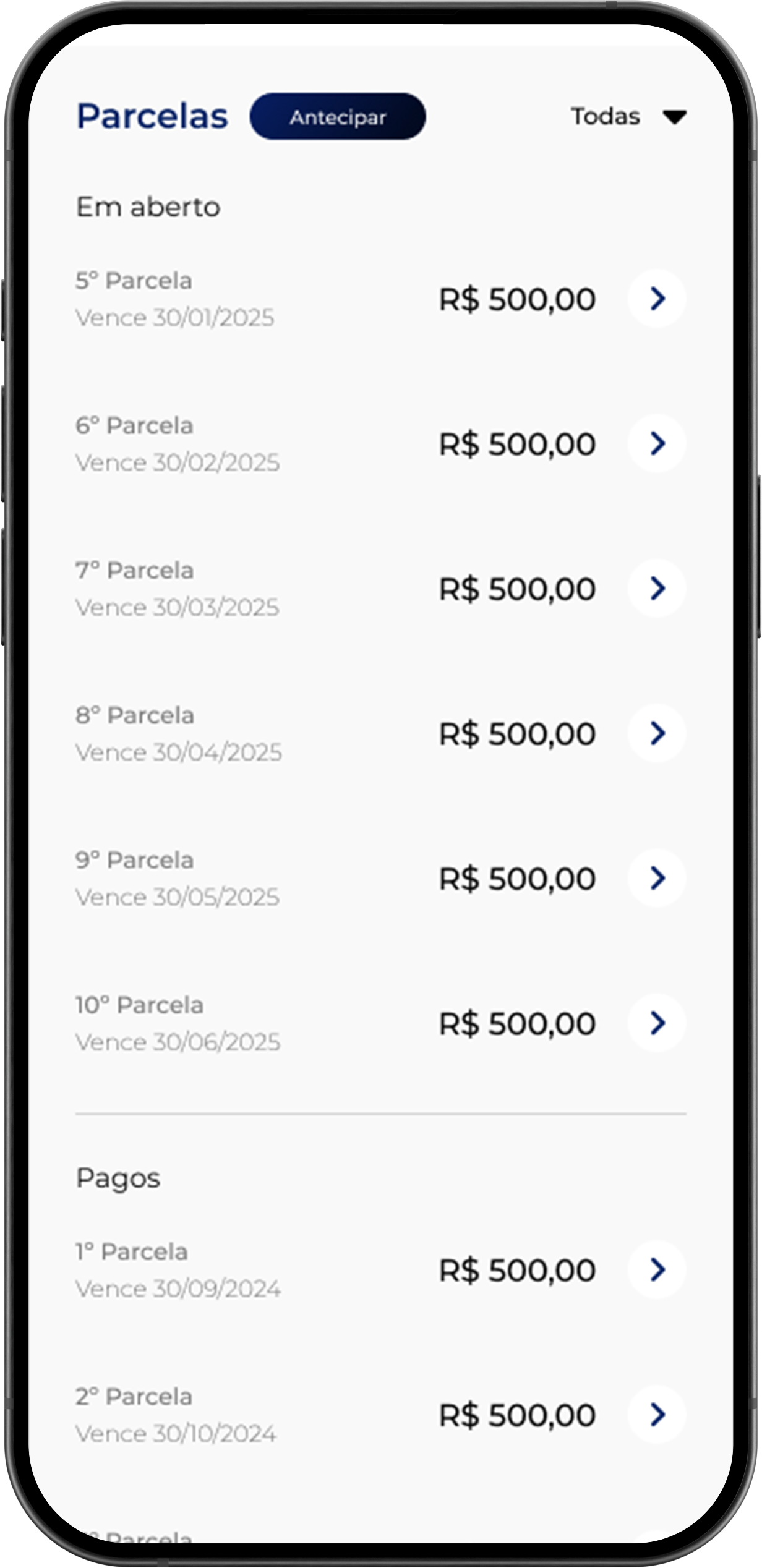

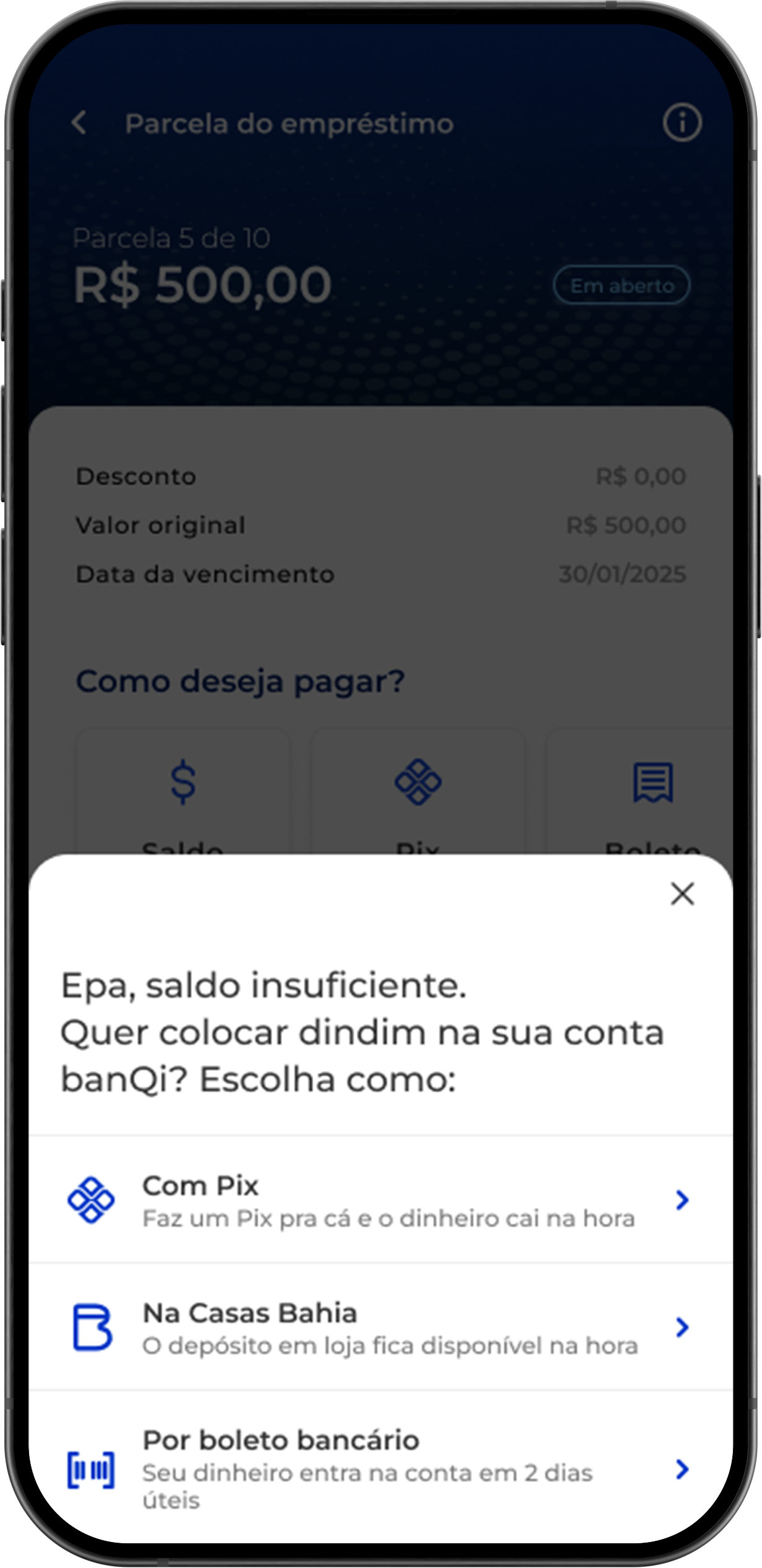

The first implementation we made was the basic feature of 'payment with balance.'

The app was initially launched with payment only through 'boleto' (a popular Brazilian payment method involving issuing a bank slip), which incurred additional costs for issuance and was not the most practical and competitive option in the market.

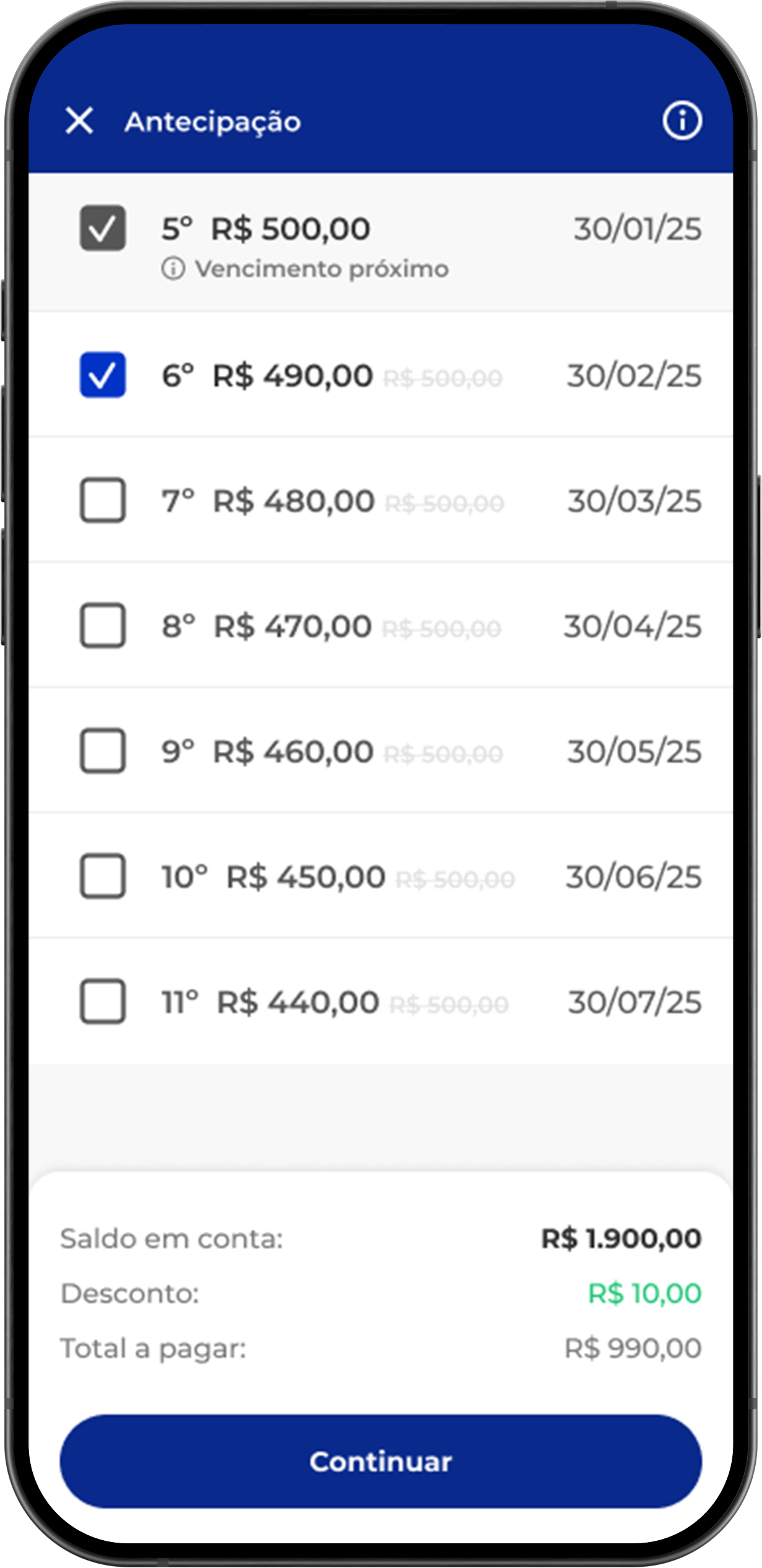

The implementation of a payment anticipation feature in the banQi app brought numerous advantages. By automating the process, users could easily request payment advances on their own, reducing the need for support calls significantly.

This streamlined approach enhanced user experience and satisfaction, while also resulting in a drastic reduction in support costs, allowing the company to allocate resources more efficiently. Moreover, users were able to take advantage of discounts for early payment, further incentivizing the use of the payment anticipation function.